Position added on that I had not added on Friday was TREE:

And Tree even shook off today's heavy selling in the broad markets.

So broad markets sold off and my positions were hit.

Most disappointing was IPI as I had decent profits in that but it could not withstand the selling so I walk away just above break even on the position:

So we learned that it is not its time to run yet. keep it on the watch list.

I realize that in looking for the BIG movers there will be many false starts and you have to be comfortable giving back profits to catch the big move.

other losers ACBFF, BOOM

Boom i got stopped out at the low, but since I added size when it appeared to be breaking out I had to tighten the stop.

ACBFF:

looked good but could not get going and then secondary and I tap out.

Only buy of the day was DRYS, which was up big in A.H. on news. This is a speculative lottery ticket type trade and have taken this trade on small shares.

Monday, January 30, 2017

Thursday, January 26, 2017

1/26 APRI

APRI:

Sling shot in the Mexican Boner Cream Stock. Small 1k Position, can add on the fishhook.

And one of my current positions went to the POWA ZONE!

Everything else was meh

Sling shot in the Mexican Boner Cream Stock. Small 1k Position, can add on the fishhook.

And one of my current positions went to the POWA ZONE!

Everything else was meh

Wednesday, January 25, 2017

Jan. 25

Closed-- OCLR

Tightened stop to Even and was hit.

No real regrets here. I was about .30 late but was okay with the entry. Moving stop to ITM gives a chance at a big profit if the stock goes but risk very little.

ACBFF- This had been looking good but today it got gapped on news that there was an upsizing of the equity deal.

I had a decent size position, but I took a stop on over half off as risk management here. The remainder has a little room to go.

IPI

Added 2.02 Turned out to be a very good add as this would rocket for much of the day.

Welcome to Stage 2!

BOOM

Add thin stock -- but this one has shown itself capable of huge moves. With infrastructure spending perhaps again...Chart shows the it is close.

Now with an increased position I need to be more careful My stop has been tightened. A stock either breaks out or it doesn't. I'm playing this breakout attempt. If there is a failure I'm out.

Prior Demonstration of Power

EVBG:

I thought this one was setting up as the best looking IPO breakout. I took it. Didn't love the late day action but remains in play.

HBM-- Although this would have been better yesterday, It looked so good, I started buying early this morning for a continuation play. That worked well.

Weekly: Shows why I like this stock. First base, weekly breakout. Has been up to 28 before.

PAST POWER:

KRNT:

Weekly -- High volume surge and base to All Time High in a "Toddler" Very powerful setup.

Tightened stop to Even and was hit.

No real regrets here. I was about .30 late but was okay with the entry. Moving stop to ITM gives a chance at a big profit if the stock goes but risk very little.

ACBFF- This had been looking good but today it got gapped on news that there was an upsizing of the equity deal.

I had a decent size position, but I took a stop on over half off as risk management here. The remainder has a little room to go.

IPI

Added 2.02 Turned out to be a very good add as this would rocket for much of the day.

Welcome to Stage 2!

BOOM

Add thin stock -- but this one has shown itself capable of huge moves. With infrastructure spending perhaps again...Chart shows the it is close.

Now with an increased position I need to be more careful My stop has been tightened. A stock either breaks out or it doesn't. I'm playing this breakout attempt. If there is a failure I'm out.

Prior Demonstration of Power

EVBG:

I thought this one was setting up as the best looking IPO breakout. I took it. Didn't love the late day action but remains in play.

HBM-- Although this would have been better yesterday, It looked so good, I started buying early this morning for a continuation play. That worked well.

Weekly: Shows why I like this stock. First base, weekly breakout. Has been up to 28 before.

PAST POWER:

KRNT:

Weekly -- High volume surge and base to All Time High in a "Toddler" Very powerful setup.

Tuesday, January 24, 2017

1/23 -1/24 Trades- Sector risk back on

1/23 -- Did a great job of being disciplined, Closed OCLR for even.

Market breadth flags here.

Trade Spreadsheet.

1/24

WATT - nailed on downgrade

Made 1.05 on this trade, probably covered too quickly but I question whether this was my trade to begin with.

Market breadth flags here.

Trade Spreadsheet.

1/24

WATT - nailed on downgrade

Made 1.05 on this trade, probably covered too quickly but I question whether this was my trade to begin with.

Saturday, January 21, 2017

PME --- Short Theory

This is a stock that caught my eye 3 years ago as a value play, and I took a long position. But as I continued to research this company I kept running into red flags. .. questionable accounting, insider transactions, and a CFO that had presided LIWA -- which was delisted for accounting fraud. Not exactly the type of management I want running companies I have my money in, so I sold for a small loss. It was a good thing I did, shortly after I bailed, the company's stock price took a huge hit after it announced that it had to re-state and several seeking alpha articles, which discussed the insider dealings.

Here is my thesis for a short position

PME has been running and has been promoting itself on a a weekly TV finance program in China --- i.e. PAID promotion. That is always a red flag:

Here is my thesis for a short position

PME has been running and has been promoting itself on a a weekly TV finance program in China --- i.e. PAID promotion. That is always a red flag:

Worse, Financial Weakness:

The last 10Q shows that revenue has fallen off the cliff and losses are quickly increasing.

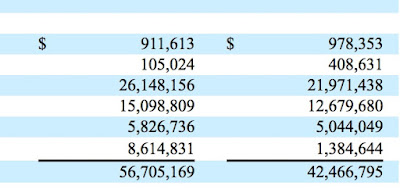

CASH -

Only 12 Mill down in cash position

Current liabilities:

56.7 Million!

Also debt has been growing over recent quarters. They are down to their last 500K and they are paying a dividend? Does that make sense? It does once you realize that the largest shareholders are the insiders.

PRIOR FINANCIAL IMPROPRIETIES

The biggest concern for this company is that the insiders have treated it as their personal piggy bank. A couple of years Ago there was a Seeking Alpha Article that that detailed all "Fishy Business" going on at PME.

"Chinese fishing group Pingtan Marine Enterprise has announced a restatement of its finances for the years 2012 and 2013, which resulted in shaving $187 million off its stockholder equity.

The change also reduced total assets by $188m."

LINK Essentially, what PME was doing was it was counting ships it had leased from INSIDERS as its own.

The Insiders have continued to treat this PME as their personal piggy bank.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The 10Q reflects numerous related party entries. I have never seen a company with more insider dealing.

The quarterly report reflects that all aspects of the supply chain are being paid to businesses owned by insiders.

The vessels

"On June 26, 2015, we entered into a master agreement with each of Fuzhou Honglong Ocean Fishery Co., Ltd, (“Hong Long”) and Fuzhou Yishun Deep-Sea Fishing Co., Ltd. (“Yishun”), which are owned by our Chairman and CEO, Mr. Xinrong Zhuo, for the acquisition of 6 fishing vessels with total consideration of approximately $56.2 million representing the fair market value on the date of acquisition."

Office Space

Office Space

On July 31, 2012, Pingtan Fishing entered into a lease for office space with Ping Lin, spouse of the Company’s CEO, (the “Office Lease”).

On July 1, 2013, we entered into a service agreement with Hai Yi Shipping Limited that provided us a portion of use of premises located in Hong Kong as office and provided related administrative service (the “Service Agreement”). ... For the year ended December 31, 2015, rent expense and corresponding administrative service charge related to the Service Agreement amounted to $462,387.

SERVICES (FUEL and Maintenance)

During the year ended December 31, 2015, we made purchase of fuel, fishing nets and other on-board consumables from PT. Avona Mina Lestari, Hong Fa Shipping Limited, Haifeng Dafu Enterprice Co., Ltd., Hai Yi Shipping Ltd., and PT. Dwikarya Reksa Abadi, of approximately $1,276,000, $11,329,000, $11,000, $4,739,000 and $1,415,000, respectively.

During the year ended December 31, 2015, we made purchase of vessel maintenance service from PT. Avona Mina Lestari and from PT. Dwikarya Reksa Abadi of approximately $6,529,000 and $3,207,000, respectively.

During the year ended December 31, 2015, we made purchase of transportation service from Fuzhou Honglong Ocean Fishery Co., Ltd. and from Hai Yi Shipping Limited of approximately $178,000 and $306,000, respectively.

RISKS To Short Position.

Squeeze? Not likely as there are 80 Million shares out standing.

Sudden news? Perhaps if indonesia opens The Company announced that its next earnings would be in March so there shouldn't be any earning surprise news to boost the stock.

Dilution? At the end of December, PME registered a 100 Million Shelf:

Dilution? At the end of December, PME registered a 100 Million Shelf:

CHARTS

From a chart perspective there is a bullish case to be made. Nice rip over the last couple of weeks but running into some supply?

DAILY -- is honoring the resistance levels on the weekly. Volume has been strong on the initial push but it is falling off on Friday's move. RSI is overbought on daily.

CONCLUSION

This is a company that has a sordid history and it appears continue operating at the status quo. The financials are quickly deteriorating and the company is nearly out of cash.

It now appears the company is trying to pump its stock price with paid promotion while at the same time it is preparing to dump a massive amount of shares on the market through its 100 Million Shelf registration.

At the end of the day, this is a fishing company, and this company is more of a fish story than a worth while investment.

Target $1.00

Thursday, January 19, 2017

1/19/ Preparing for a bear

Stopped REXX

This one should still be in play. Wait for it to reset and slingshot.

EMES -- good move and moved stop up to ITM which was hit... this is not a strong market.

Weak after the move

DPLO:

Short

WATT:

This may require a shake in the broad market for this to work but I don't see the bullish theory working at this point. The base is simply not long enough and a high volume reversal following a breakout should be seen as a warning flag. This stock has a history of making severe pull backs once they start.

Short Feb 15. calls.

Stop 19.50 on stock

OCLR

Lots of resistance at this point despite the high volume earnings move. This is a pattern that will be hard to cut through so I'll use the resistance as a stop and look for a fade.

Short. 9.34 stop 9.70

This one should still be in play. Wait for it to reset and slingshot.

EMES -- good move and moved stop up to ITM which was hit... this is not a strong market.

Weak after the move

DPLO:

Short

WATT:

This may require a shake in the broad market for this to work but I don't see the bullish theory working at this point. The base is simply not long enough and a high volume reversal following a breakout should be seen as a warning flag. This stock has a history of making severe pull backs once they start.

Short Feb 15. calls.

Stop 19.50 on stock

OCLR

Lots of resistance at this point despite the high volume earnings move. This is a pattern that will be hard to cut through so I'll use the resistance as a stop and look for a fade.

Short. 9.34 stop 9.70

Wednesday, January 18, 2017

1/18/17 lack of discipline, boredom trades.

My daughter has the flu and I stayed home with her on the couch this morning. I looked at the screen way too much and paid the price. I made a number of poor decisions.

First: APRI -- Mexico approved their boner cream.

Entry: I actually got a great entry 1.88 on the news but should out into the first push 2.30 it would go to $4.00 but this is not my trade. made $410 but this still earns a dollar in the jar.

REXX

Stage 2 transition.

Entry 0.94

Sector is working. Pushed this too much without a base but I haven't written this one off yet.

.

CLOSED:

MPET:

Got hit on Street Sweeper article. Still a profitable trade but that type shit of stuff will always piss me off.

Then put on a revenge trade hoping it would bounce. Tight stop, but Another dollar in the jar.

LIVE:

This made a push but couldn't hold it. Kept the stop tight and position small but base was not big enough to take this trade on no volume. No reason to push this trade.

CSRA:

Wash Trade, I gave it a breakout attempt and it couldn't make a move-- always dangerous at a high and likely foreshadows a pull back.

CNAT:

Stopped out-- just didn't work. but traded to plan.

IPXL: entered 13.05

Covered 12.40 -- Micromanaged as this started to bounce back from 12.05 -- Saw loses from other positions (MPET) turn my day from very positive to negative. So I booked $500+ on this. Was this my plan, no I was playing for the breakdown. --- Dollar in the jar.

NEW:

EMES. 14.37

This is a stock I'm very familiar with. With this type of volume, it often wages a multi day run. The sector has been strong so this is a trade I would take on the breakout of range. But no reason to give this much room.

Spreadsheet Issues?

According to my broker, the 55K Account is now up 8.3% YTD

But my spreadsheet is reflecting a gain of only 4.66%- and is exactly $2,000 off.

Which means I have a problem somewhere. Now to find that missing 2K

Tuesday, January 17, 2017

1/17/206 -- Trade Journal

CLOSED GRVY

Fantastic Swing.

First sale =1.10

2nd 2.20

This was thin but worth taking the position as it broke range. Big Reward.

IRTC:

Stopped out:

I took the "Reclaim the Fame" breakout despite low volume ad there was no follow through. I didn't mind the shallow pull back but today my stop got hit and I got crushed on slippage, causing an extra .68 of loss. Fortunately position size was small but that much slippage is not fun.

New Trades:

ACBFF:

Slingshot w/ range breakout

AAOI: week 1 breakout

Fish hook after pull back.

Took a starter position as this is not the ideal setup-- but it is the setup that works to get in the MOST POWERFUL stocks. If AAOI behaves as such this will double.

Weekly

DAILY:

PME:

Short

Setup-- Bridesmaid

The bride is the initial Day 1 move

. The bridesmaid is the what's left over after the party... and this one is especially ugly.

I have researched this stock in depth in the past: http://sostrading.blogspot.com/2014/06/pme-cutting-bait.html

The financials have deteriorated significantly and the company filed a 100Mill Shelf in December.

Fantastic Swing.

First sale =1.10

2nd 2.20

This was thin but worth taking the position as it broke range. Big Reward.

IRTC:

Stopped out:

I took the "Reclaim the Fame" breakout despite low volume ad there was no follow through. I didn't mind the shallow pull back but today my stop got hit and I got crushed on slippage, causing an extra .68 of loss. Fortunately position size was small but that much slippage is not fun.

New Trades:

ACBFF:

Slingshot w/ range breakout

AAOI: week 1 breakout

Fish hook after pull back.

Took a starter position as this is not the ideal setup-- but it is the setup that works to get in the MOST POWERFUL stocks. If AAOI behaves as such this will double.

Weekly

DAILY:

PME:

Short

Setup-- Bridesmaid

The bride is the initial Day 1 move

. The bridesmaid is the what's left over after the party... and this one is especially ugly.

I have researched this stock in depth in the past: http://sostrading.blogspot.com/2014/06/pme-cutting-bait.html

The financials have deteriorated significantly and the company filed a 100Mill Shelf in December.

Subscribe to:

Posts (Atom)