Track New Ipos

The first, and arguably most important thing, is to actually track IPOs as the come public. I put each one on a watchlist for that particular year because many will run together.My favorite Site is Ipo Boutique for IPO research. which lists IPOs month by month and year-by-year. It is a great historical resource, which I've used for my studies.

The IPO Infants 1-8 Months from trade date

IPO infants are very temperamental. They very rarely make for a successful buy and hold. But they can make incredibly powerful moves. Better yet, on the whole, the majority will make at least a +30% run, so they give great opportunities. It's important to treat these like swing trades, Trim on the rips.

AAOI was a very tradable infant. - Largely ignored by the crowd vol came in, which gave you a 30% move though the IPO day close and then another move from 13 to 16.

Another common pattern:

An IPO, that holds its IPO price and then has enough vol. come in to hold a gap, is a great sign of strength

The "Hype" Fade

It's pretty common for IPOs that are hyped products to fade over the next week or so. Also, a big opening day trading range is a caution. But that doesn't mean that the stocks don't show them self for profit opportunities.

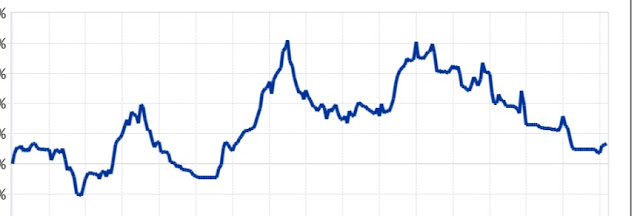

SNAP for example was considered a loser IPO by most, I did well on it, trading it exclusively on the long side.

It faded hard from the opening, but notice the range contraction right at the 13 days in after it hammered the day before -- That should put it on the watch list. I bought the next day as volume came in but perhaps. It worked ok. It then gave another opportunity finding support at the previous level. I didn't have any confidence to take it in to earnings so I sold the day of and missed the carnage.

PI:

Like AAOI - held the initial range. So basically the buy signal is range expansion + Vol.

BE:

Buy signals, narrow range follow pull back then expansion. Vol came in above the average days.

TME:

One I'm holding now, the initial Dip could have been bought but wasn't crazy about the vol. at that point. I waited until it moved above IPO close price and took the position. I got lucky on my trim as it turned out because it looked like it was going to go a lot higher. Sell in to strength in these.

QTT:

Volume comes in as price picks up through IPO open and day 2 close.