Coming in to this past year, my weakness was not being able to hold my winners long enough. So I set a goal for myself to take on the year with a "home run" mindset:

Regardless of the end result, I feel that approach was critical for my development as a speculator and I've said it at various points this year that I feel that I'm still 3 years away from being very good at this game.

I needed to teach myself what it felt like to be in big winners, what it felt like to manage the trade, what emotions I would deal with along the way, and what the ultimate exit signals would look like. I also needed to teach myself what it felt like to take a big position and to hold that position, and to get out of that position when I was wrong. Obviously, that's a lot to learn and at times, I got it right, and at times I got it very wrong.

So the good:

I hit some big trades:

AAXN:

NFLX: Between my positions made about 70 points

MDB:

The Bad:

My worst stock of the year. This was a culmination of many attempts to get pull back entry (with size). The most disgusting part about this stock, was I started off with a huge profit. Within 3 days, the calls I bought for $2 were trading for $15.

What I failed to realize was this was the blow off to the upside. Instead I was convinced that it would resume on the uptrend after pulling back to the 10 ema. So I was adding shares and size. Ultimately not only did I give back the entirety of my options gains, I through big losses on the 3 or 4 times I tried to enter on common stock.

TWTR:

I was in early, and first entry worked but didn't give the cushion for earnings. OF course, it gaps and I got fomo and bought with size and got my butt kicked.

HEAR:

Another one multiple attempts, my time was never good enough:

I knew this would be a big winner, and I constantly stalked it but my timing was off (or at least stops and position size. Got knocked out with interlay reversals.

The UGLY

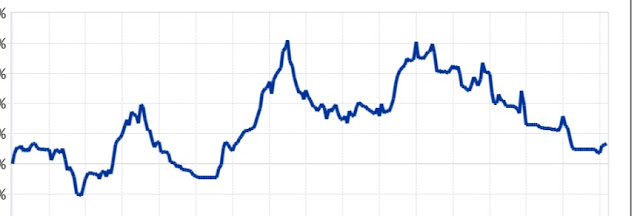

The Ugly had to be my equity curve through out the year.

At times I had massive surges in very short periods. But the backside was awful. The last quarter was ugly for several reasons.

First, I was right on the market, I suspected when we were putting a top in during October and even moved all my stops up into the gap.

How can I be so right:

I saw the signal, moved my stops up to the gap-- yeah I gave up some profits but that's the cost of doing business.

I went to cash

Recognized the start of the bear

And still got my butt kicked.

The problem was I didn't realize that the character of the market had changed, and I was trying to trade the way I did at the beginning of the year, where I would get into positions, get big gains, and ride the trend.

The buy signals in Q4 were pretty much the same as the rest of the year and they worked.

My problem; however, was after a massive rally -- and notice that throughout Q4 I had big spikes in my equity only to give up more over the next sessions.-- was that the character of the market had totally changed and I was still trying to trade the same way as I did in May.

I had several massive up days only to be holding a lot of stock and then have the market turn on me the next giving back all those gains and more.

Lesson No. 1.

Holdable Trends arise out of low volatility environments. The buying pressure is heavily in favor of the bulls so volatility dries up.

Lesson No 2

After an extended rally and the market gaps up. Sell into it or raise stops. Sell into quick spikes-- they will need a lot of time to re-set-- look at DBX chart

Lesson No. 3 - Recognize character change. When the market goes from calm and orderly markup to wild distribution don't expect to hold for the big trade. Recognize the situation,Volatility is character change of the market. I must shorten my swing and profit goals.

Lesson No. 4

When market volatility returns. Sell into spikes hard and don't rush to get back in.

2019 trade goals:

1.Situational Awareness -- expect chop, rising interest rates will have an effect on corporate earnings, political environment etc... Don't marry a position, don't marry an opinion.

2. Recognize opportunity - don't fall asleep at the wheel, there will be sectors and stocks that do well -- watch them - but you don't have to be the first in the water.

3. Manage risk, -- get your position sizes right.

4. Manage emotions: Fomo No mo'

No comments:

Post a Comment