My BOXand ARRY buys gap, Sold off half BOX, the remainder runs. manage risk sell off some ARRY I can live with that. RESN runs I sell into that run. AAPL proves why it the worlds most valuable company. My calls are up big. My EMES puts gain as EMES falters. I bought some NFLX it runs, Bought some GNVC and HPJ off bounces If they firm up I'll be sitting very pretty and then TWTR looks like NFLX q1 2014 as it rallies off the gap test and finally I add PME in A.H. off news that it has eliminated its V.I.E. structure and received an investment which would value the company at 800 million or a stock price of 9.50

I haven't taken stock and given the full run down my holdings without further adieu charts:

BOX:

IF only every stock I bought did this in yesterday at 19.30 close today 20.99. Still I think this has a chance to take back its IPO high close of over 23, we will see.

ARRY:

Wedge breakout. I did a partial sale at 7.98 because it gapped in the morning and faded. It then regained some strength. This will be off to the races if it can get some space over 8.

EMES

Continuation to the downside following the rejection by the 10week avg. If another continuation day look for low 50s

HPJ

I liked the bounce and reversal off the gap. My working theory is that this will now come around to make another run at 6.00

Entry 5.40

NFLX has that power move potential. I bought today at 451.37 and caught a decent piece of this 10.00 move. I sold off half the position at 455.10 to manage risk. If this can get some continuation. I would think $475 is in play over the next couple of weeks.

No changes to position, none anticipated as this run is just starting looking for 128.

TWTR:

A power move gap, which has thus far stuck. I bought this move as TWTR rallied off the gap. The low of the day presents a great stop making this a well defined trade. If it gets over 48 I will consider adding as it will break range and show trend.

PSXP

Nice consolidation, which is needed to push over 80. I've cut down my position. I will re-initiate my position on a a pull back to 75 or a break above 80.

GNVC:

This is a high momentum stock that they attempted to breakdown. Right on the trend line it rallied hard. That tells me this is still "in play" I'll take a piece here at 4.00.

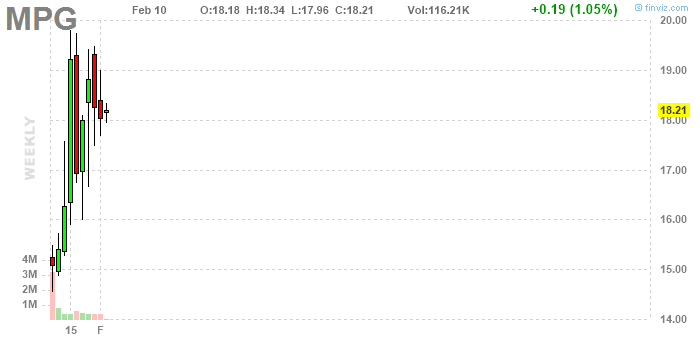

MPG:

Weekly. Still holding a small position. This has had some momentum and could be a decent winner if it gets going. Right now this range is getting very tight

WATT:

This company has a really cool product which lets you charge wireless devices without plugging them in. It won a number of CES awards.

In many ways its similar to RESN. I've bought the consolidation here small, which I'll cut if it breaks to the down side and add if it breaks to the upside.

The Grand Finale

PME

I'm treating PME as An episodic Pivot Here's the news:

PME is "a global fishing company based in the People's Republic of China (PRC), today announced that the Company's wholly-owned subsidiary, Fujian Provincial Pingtan County Ocean Fishing Group Co., Ltd ("Pingtan Fishing") has entered into an Investment Agreement ("Agreement") with China Agriculture Industry Development Fund Co., Ltd, ("China Agriculture") pursuant to which China Agriculture will invest RMB400 million (approximately US$64.0 million at current exchange rates) into Pingtan Fishing for an 8% equity interest in Pingtan Fishing's operating company. The investment values Pingtan Fishing at approximately 5 billion RMB, or US $800 million at current exchange rates. The closing and funding of this strategic investment is expected to occur no later than February 13, 2015."

END of VIE structure!

When I previously looked at this stock I found the VIE structure too complicated and too sketchy to invest. Today's news removed my objection:

"Pingtang terminated its existing variable interest entity agreements, or VIEs, as permitted by the laws of the People's Republic of China. This provides the shareholders of Pingtan Marine Enterprises with direct ownership of its subsidiaries rather than contractual ownership through the VIE structure. "

- PE Ratio of 2!

Summary

I believe that this is a game changer and bought at 4.10 and 4.20 in A.H. Even with the appropriate China discounts PME should trade north of $7. But again, It is Chinese and I'm not going to go overboard until I get my hands on the SEC filing for this deal.

No comments:

Post a Comment