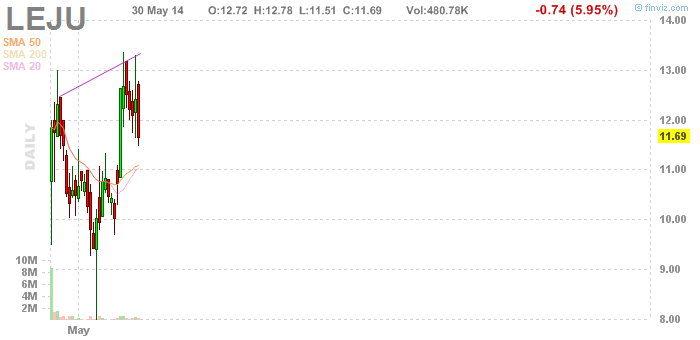

I closed the remainder of my Leju position out today when it broke 12. Today presented a big red bar. Under the right circumstances, I could have tried to ride out the move since I had already reduced my position by 1/2 and hope for a reversal. I elected not to do so because SFUN (which I sold yesterday), a competitor of LEJU absolutely got hammered today--over 7%. If other stocks in an industry get hammer it is best not to see if your stock is the sole survivor. Leju held up for most of the day, but 12 ultimately caved as well. 12 was my mental stop. After I sold LEJU quickly dropped to as low as 11.51.

Summary: in at 10.65 (5/13). Out 1/2 at $11.91 (5/28) Out 1/2 $11.90 (5/30) for an 11.83% gain.

No regrets about this trade. My analysis when I entered is here. Although earnings were great it is a thinly traded stock that I don't want to wait for it to make its move. This stock is more than capable of very quick sell-offs as it is of big gains. Note the severe sell off earlier this month. If it is not actively being pushed up it could fade just as fast. So did I gamble a bit on earnings? Absolutely, but I was rewarded with that big green bar and a nice profit on the trade.

No comments:

Post a Comment